AI Universal Income Explained : AI Cuts Costs, but Who Really Keeps the Gains?

Imagine a world where every household receives a guaranteed monthly income, no strings attached. Now, contrast that with a future dominated by artificial intelligence (AI), where machines transform industries, automate jobs, and generate unprecedented wealth. Here’s the twist: over $1 trillion has already been poured into AI development since 2015. What if that same sum had been distributed as universal basic income (UBI) instead? Would society be better off with a financial safety net for all, or does AI’s promise of long-term innovation outweigh the immediate relief of cash in hand? This is not just a thought experiment, it’s a pressing question as AI reshapes economies and deepens debates about fairness, opportunity, and the future of work.

Below Caleb Writes Code explores the profound economic and social trade-offs between investing in AI and directly redistributing wealth through UBI. You’ll uncover how AI-driven automation is transforming industries, creating efficiencies, and displacing workers, while also examining whether policies like AI taxation could fund solutions to growing inequality. Along the way, we’ll grapple with philosophical dilemmas: Can AI truly serve humanity’s basic needs, or will it exacerbate disparities? By the end, you’ll have a clearer understanding of the stakes, and the choices, that will define whether AI becomes a tool for universal prosperity or a driver of division. The answers may challenge your assumptions about progress and fairness in the age of machines.

AI vs. Economic Redistribution

TL;DR Key Takeaways :

- Over $1 trillion has been invested in AI since 2015, sparking debates on whether this investment delivers more societal value than distributing the same amount as universal basic income (UBI).

- AI investments aim to drive long-term economic growth through innovation and efficiency, but critics highlight risks like job displacement, wealth inequality, and uneven benefit distribution.

- AI-driven automation is transforming industries, reducing costs, and increasing efficiency, but it also raises concerns about unemployment and economic inequality, particularly for low- and mid-level workers.

- Proposals like taxing AI-generated wealth to fund UBI aim to redistribute economic gains and support displaced workers, though implementation challenges and risks to innovation remain significant.

- AI’s societal impact depends on deliberate policy interventions to ensure equitable benefit distribution, addressing disparities in access to technology, education, and resources to prevent deepening inequalities.

AI Investment vs. Universal Basic Income

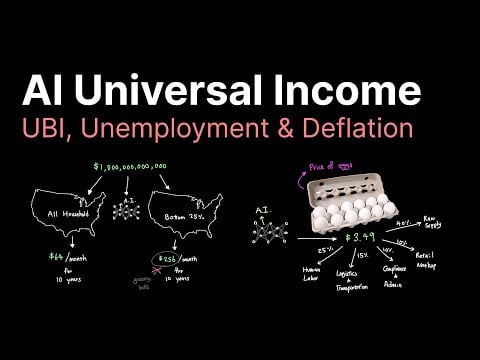

Consider the alternative scenario: if $1 trillion had been distributed as UBI over the past decade, every U.S. household could have received approximately $64 per month. For the bottom 25% of earners, this amount would rise to $256 monthly, providing a meaningful financial cushion for low-income families. Such redistribution could have addressed immediate needs, alleviating poverty and reducing financial stress for millions.

In contrast, AI investments are designed to generate long-term economic growth by driving innovation, improving efficiency, and creating new industries. Proponents argue that these investments have the potential to transform sectors ranging from healthcare to transportation, ultimately benefiting society as a whole. However, critics question whether the societal value created by AI justifies the significant risks it poses, such as job displacement, wealth inequality, and the uneven distribution of benefits.

Historical parallels, such as the Industrial Revolution, suggest that technological advancements often widen wealth gaps before eventually improving living standards. The challenge lies in managing this transition effectively to ensure that the benefits of AI are broadly shared rather than concentrated among a select few.

The Impact of AI on Jobs and Automation

AI-driven automation is transforming the labor market at an unprecedented pace, replacing jobs across a wide range of industries. Companies like Amazon have automated hundreds of thousands of roles, while even traditionally secure professions, such as software engineering and legal analysis, are increasingly at risk of being outsourced to AI systems. While automation enhances efficiency and reduces costs, it also displaces workers, particularly in entry- to mid-level positions, raising urgent concerns about unemployment and economic inequality.

At the same time, AI’s deflationary effects are becoming more apparent. By lowering production costs, AI makes goods and services more affordable, benefiting consumers. For example, tasks like website development, customer service, and even agricultural production have become more efficient and cost-effective due to AI advancements. However, these benefits are not universally accessible. Physical resource constraints, such as limited raw materials or energy supplies, remain significant barriers to achieving widespread abundance. This duality underscores the complexity of AI’s economic impact, where gains in efficiency coexist with challenges in equitable distribution.

AI Spending or Universal Cash, Who Benefits in the Long Run

Unlock more potential in Artificial Intelligence (AI) by reading previous articles we have written.

- Linus Torvalds shares thoughts on artificial intelligence (AI) in

- Connectomics : Mapping the Brain using artificial intelligence (AI

- Machine Learning, Deep Learning and Generative AI explained

- New ZOTAC ZBOX Edge mini PCs accelerated with artificial

- The Limitations of AI: Why Artificial Intelligence Still Needs Human

- AI vs Humans : Will Artificial Intelligence Surpass Human

- Apple’s New AI Strategy for Artificial Intelligence Beyond 2025

- Artificial Intelligence vs Quantum Computing

- Nvidia CEO Jensen Huang Declares AI a $100 Trillion Opportunity

- Eric Schmidt’s Predictions on AI and Its Unpredictable Future

Taxing AI to Fund UBI

One proposed solution to address the disruptions caused by AI is to tax AI-generated wealth and use the revenue to fund UBI. This approach aims to redistribute the economic gains from AI to those most affected by automation, providing a safety net for displaced workers and vulnerable populations. However, implementing such a tax presents significant challenges. Policymakers would need to define taxable AI activities, close potential loopholes, and ensure that the system is both fair and effective.

For instance, determining how to tax AI systems that operate across borders or contribute to global supply chains would require international cooperation and regulatory innovation. Without careful design, such a policy could fail to achieve its intended goals, leaving those most in need without adequate support. Additionally, there is the risk that overly aggressive taxation could stifle innovation, discouraging investment in AI technologies that have the potential to drive long-term economic growth.

Philosophical and Practical Considerations

Beyond the economic implications, AI raises profound questions about societal priorities and values. Can AI be harnessed to meet basic human needs, such as food, shelter, and healthcare, as envisioned by Maslow’s hierarchy? Or will it lead to unintended consequences, such as reduced human interaction, loss of purpose, and the misuse of technology? These questions reflect broader concerns about whether AI will create universal abundance or exacerbate existing disparities.

For example, while AI has the potential to improve access to education and healthcare through personalized learning platforms and diagnostic tools, it also risks deepening digital divides. Those without access to technology or the skills to use it effectively may find themselves increasingly marginalized in an AI-driven economy. Addressing these disparities requires thoughtful policies and investments in education, infrastructure, and social programs to ensure that the benefits of AI are accessible to all.

The Future of AI and Economic Redistribution

Looking ahead, AI has the potential to generate significant economic surplus, potentially reducing national debt and funding public services. However, without deliberate policy interventions, its benefits are unlikely to be evenly distributed. Wealth concentration remains a pressing concern, as does the uncertainty about whether AI can fulfill its promise of widespread societal benefits.

The central question is not just whether AI investments will pay off but how society can ensure that the gains are shared equitably. Policies such as UBI, AI taxation, or targeted social programs could play a crucial role in bridging the gap between technological progress and societal needs. However, these measures require careful planning, political will, and public support to succeed.

- Will AI investments ultimately create a more equitable society, or will they deepen existing inequalities?

- Can policies like UBI or AI taxation effectively address the challenges posed by automation and wealth concentration?

- What role will you play in shaping the future of AI and economic redistribution?

The answers to these questions will determine whether AI becomes a tool for universal prosperity or a driver of greater disparity. The choices made today will shape the future of work, wealth distribution, and societal well-being for generations to come.

Media Credit: Caleb Writes Code

Filed Under: AI, Technology News, Top News

Latest Geeky Gadgets Deals

Disclosure: Some of our articles include affiliate links. If you buy something through one of these links, Geeky Gadgets may earn an affiliate commission. Learn about our Disclosure Policy.